The IRS has collected $1.3 billion from high-wealth tax dodgers since last fall, the agency announced Friday, crediting spending that has ramped up collection enforcement through President Joe Biden’s signature climate, health care and tax package signed into law in 2022.

Treasury Secretary Janet Yellen and IRS Commissioner Danny Werfel traveled to Austin, Texas, to tour an IRS campus and announce the latest milestone in tax collections as Republicans warn of big future budget cuts for the tax agency if they take over the White House and Congress.

Yellen said in a speech in Austin that in 2019, the top one percent of wealthy Americans owed more than one-fifth of all unpaid taxes, “leaving ordinary Americans to shoulder the burden.”

Fund👏the👏IRS👏

Oh noes they’re gonna do investigations and prosecutions? Fuck you, pay your taxes. There is zero moral justification for refusing to properly fund the IRS.

As long as the audits focus on high value targets. It should not mean predominantly auditing the mass as there is more fuckery with more money at the top.

I’m okay with mid value targets too. A lot of small business owners are tax cheating bastards as well as fortune 500 companies.

Business should get 100pct audits imho.

mandatory audits over a minimum net worth or valuation?

deleted by creator

The Republican response is literally that they’re going to defund the IRS. If there weren’t 100 other things demonstrating that the Republican party serves the ultra rich, and not the people, it would be astonishing.

It’s not really a surprise that their position is that rich people should be allowed to break the law.

It’s kind of amazing how upfront they are about it

They know SCOTUS has their back.

Did they charge any of them with a crime for not paying taxes, or did they just let them pay without penalty?

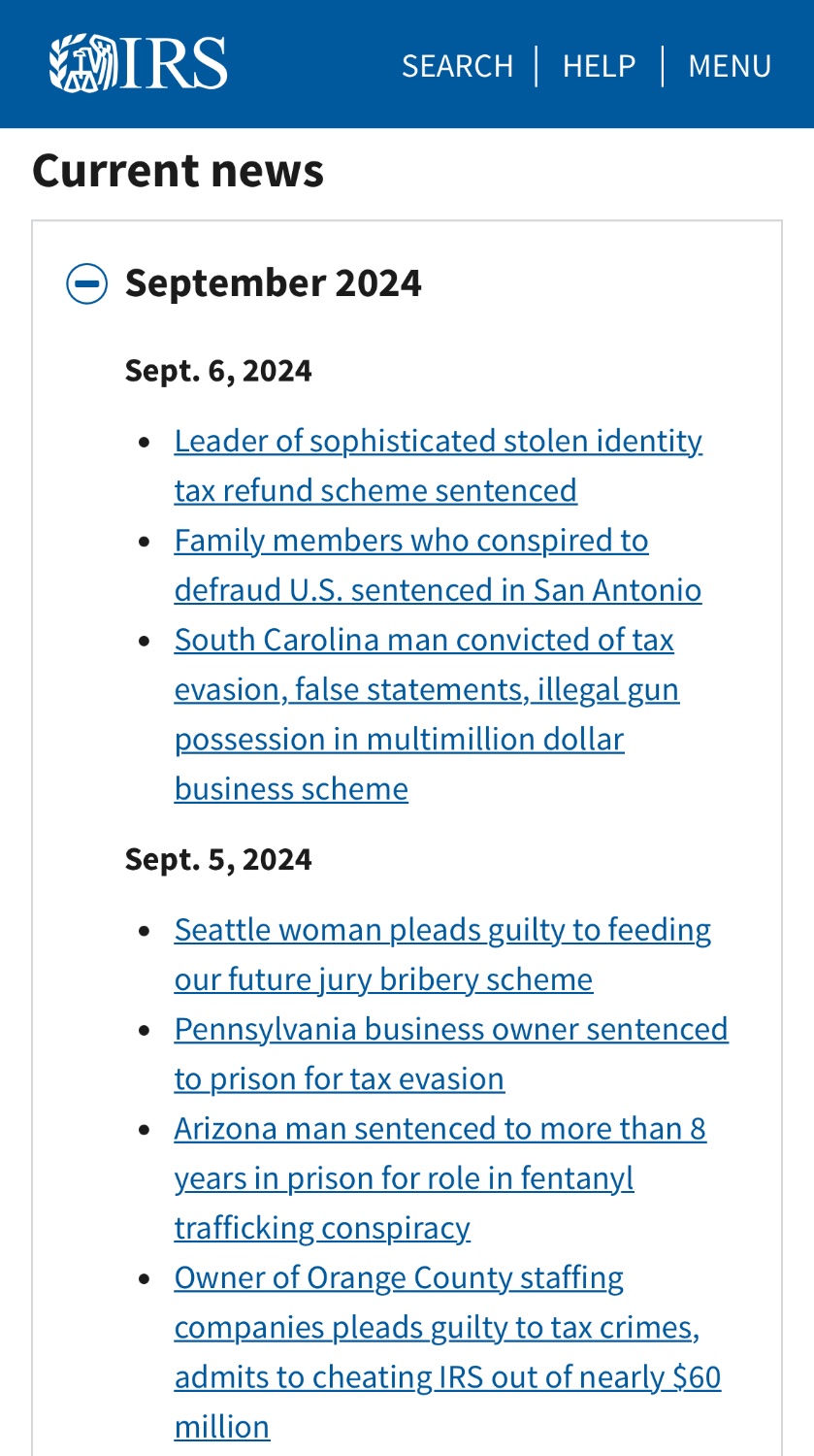

Justice boner material. They have a newsletter!

Daily crime journal wow

Ooo this might be fun to bookmark

The IRS might need a bigger budget to make them morally pay. Prosecution is expensive.

I’m entirely in support, of course, so I say we should increase the IRS’s budget and do it. But I also get why the IRS doesn’t want to walk up to Congress right now, hat in hand, and say “We spent more money prosecuting them than we gained” or anything close to that, and give the GOP ammo for defunding them again.

Yeah I’m hoping they snowball this money into pursuing others, and funding the ability to enforce these large bill dodges

For-profit framing of public services is indeed a problem, as we can see with prisons too. Probably, it’s better to call their avoided taxes stolen money, money stolen from regular citizen, and the return on them as a punishment for theft. And then point out how many investments in public infrastructure and services could’ve been done for these money: in miles of roads not layed, in new schools not built, - and that’s the same weight goes onto shoulders of regular Joes who millionaires stole them from. And insist that this kind of theft should be punished, for if regular americans are obligated to suffer the tax filling and paying process, it’s unfair these chuds with hired accountants and lawyers don’t.

But I also get why the IRS doesn’t want to walk up to Congress right now, hat in hand, and say “We spent more money prosecuting them than we gained” or anything close to that, and give the GOP ammo for defunding them again.

https://www.cbo.gov/publication/60037

Actual outlays for enforcement. Outlays for enforcement activities in 2023 were less than projected. Most of the expenditures from the enforcement account stem from labor costs, and through 2023, the IRS hired fewer revenue agents (the enforcement staff who handle complex audits) than it had planned. That shortfall suggests that the IRS has encountered greater difficulty in hiring auditors than it anticipated. CBO expects that the IRS will be able to use all the mandatory funding that it designated for hiring in later years, but because of the delays in hiring and training new auditors, revenue collections from enforcement activities are smaller in CBO’s February 2024 projections than they were in its previous projections.

At the very least an unpaid balance accrues interest and penalties

Only hunter Biden lol

annoying how even 1.3 with a b feels like a drop in the bucket of what’s being stolen from us.

It’s a start; if that recovered money was funnelled directly back into the IRS, they could net as much as a 6x return:

A few years of IRS hyper-vigilance and investment would result in significant gains to the public purse, ensuring that the wealthiest pay their fair share.

This helps thanks lol

It absolutely pales in comparison to the amount stolen from us day by day, but it’s more than we usually get, so I’ll be happy about that.

My guess it’s a 100x more than what the IRS has retrieved, but it’s a start at least.

It is a drop. The deficit is 1.7 trillion, the amount of money the irs has recovered is less than .1% of the money being spent as debt. That’s just the government leveraging the future. It’s also representing 3.5 or more billion in income that taxes weren’t paid on, which likely could have been better wages instead of more income for billionaires.

Good - keep going!

The wealthy are a bunch of con persons. Spend your time on them and you will make a fortune.

It’s almost as if the ultra rich are greedy leaches on society ¯\_༼ᴼل͜ᴼ༽_/¯

New source of revenue achievement unlocked!

Where are all the people saying the parties are exactly the same?

Funny, every single other thread these days have maga trolls discouraging left wingers from voting.

But when it comes to these kind of threads where the difference is obvious, the conservative lobbyists seem to disappear

Again, they’re not the same

BuT GeNoCiDe!1!1

A good start!

From the thumbnail, I assumed this was a British story for some reason.

Yes it’s funny how we assign a hairstyle to region

And Republicans react by wanting to cut more from the IRS to fund their campaigns through wealthy tax cheats.

shockedJanetYellenFace.jpeg

deleted by creator

Taxes are what you pay to live in a functioning society. To use the roads, the utility poles, the emergency services. If you don’t pay your taxes, you should be banned from using any public services.

So good luck having a place to drive your fancy cars, millionaires.

Who’s Yellen now? (This song was actually commissioned by APM’s Marketplace when Janet Yellen became Secretary of the Treasury, but feels appropriate now.)